Behind Every Successful Claim: The Real Value of Medicare Equipment Billing in San Diego

When people think of healthcare, their minds often go straight to doctors, nurses, and patient care. Yet, behind every smooth-running clinic and successful patient outcome lies something far less visible but equally essential: accurate and efficient Medicare equipment billing. In San Diego, where healthcare innovation meets community wellness, medical providers rely heavily on these billing processes to stay compliant, ensure timely reimbursements, and maintain operational flow. This article explores how Medicare equipment billing services in San Diego play a vital role in supporting healthcare facilities, patients, and the broader medical ecosystem. Understanding Medicare Equipment Billing Medicare equipment billing, also known as DME (Durable Medical Equipment) billing, involves the process of filing claims for items like wheelchairs, oxygen supplies, hospital beds, and other medical devices prescribed to patients for home use. While this may sound straightforward, the reality is far more intricate. Each claim must meet Medicare’s specific documentation, coding, and compliance standards. Even the slightest error such as an incorrect code or missing physician note can result in claim rejections or payment delays. That’s where specialized billing services in San Diego step in, ensuring that healthcare providers get reimbursed fairly and promptly. The Hidden Complexity Behind Every Claim Behind a single Medicare claim lies a chain of crucial steps: Without professional expertise, these steps can easily become overwhelming especially for clinics and home healthcare providers who must also manage patient care. That’s why medical billing companies in San Diego are not just service providers; they’re strategic partners in ensuring smooth financial operations. Why Accuracy Matters in Medicare Equipment Billing In the Medicare billing world, accuracy isn’t optional, it’s everything.A single coding error or mismatched document can cause delays, denials, or even compliance penalties. For example:A San Diego clinic providing respiratory equipment might use the wrong modifier code for a patient’s home oxygen system. The claim could then be denied, leading to financial losses and administrative backlogs. Professional billing teams eliminate these risks by: By ensuring every claim is precise and compliant, they help healthcare providers focus on what truly matters to patient care. The Role of Billing Experts in San Diego’s Healthcare Ecosystem San Diego’s healthcare industry is both dynamic and demanding. From small clinics to large medical equipment suppliers, everyone relies on timely reimbursements to sustain operations. Medicare equipment billing specialists serve as the bridge between providers and payers. Their local expertise gives them an edge in understanding California’s evolving insurance landscape and Medicare regulations. They handle: These services collectively ensure healthcare businesses maintain financial health while staying compliant with federal and state laws. The Real Value: Financial Stability and Patient Trust The true impact of professional billing services goes beyond paperwork. It directly influences how healthcare providers operate and how patients experience care. 1. Improved Cash Flow Timely reimbursements mean clinics can reinvest in better equipment, hire more staff, and expand services ultimately improving community healthcare in San Diego. 2. Reduced Administrative Burden By outsourcing complex Medicare billing tasks, providers free their teams to focus on patient care rather than paperwork. 3. Compliance and Peace of Mind With ever-changing Medicare guidelines, compliance is critical. Professional billing specialists ensure every claim aligns with the latest standards, minimizing the risk of audits or penalties. 4. Enhanced Patient Experience When billing is smooth and transparent, patients face fewer financial surprises, leading to higher satisfaction and trust. Technology’s Role in Modern Billing In 2025 and beyond, technology continues to transform Medicare billing services in San Diego. Automation, AI-driven coding systems, and secure cloud-based platforms have made claim handling faster, more accurate, and more transparent than ever before. Modern billing software can: These tools help billing teams achieve efficiency while ensuring that human oversight remains at the core of quality control. Challenges That Professionals Help Overcome Even with advanced tools, Medicare equipment billing remains a challenge for many providers. Common issues include: Professional billing services in San Diego address these challenges by offering continuous staff training, policy monitoring, and customized billing strategies that adapt to each healthcare provider’s needs. Why San Diego Providers Choose Local Billing Experts Local expertise matters.San Diego’s healthcare providers often prefer working with local medical billing companies that understand the regional payer mix, patient demographics, and industry expectations. Local teams also offer: This localized approach creates a seamless billing experience that strengthens trust between providers, patients, and payers. Final Thoughts Behind every successful claim lies a network of effort, precision, and expertise. Medicare equipment billing services in San Diego aren’t just about data entry they’re about maintaining the financial heartbeat of healthcare. By blending technology, knowledge, and compliance, these professionals ensure that every claim tells a story of efficiency, accuracy, and care. For providers aiming to stay compliant, reduce denials, and keep their focus on healing lives, expert billing support isn’t just valuable, it’s essential. FAQs Q1. What does Medicare equipment billing include? It includes billing for medical devices such as wheelchairs, hospital beds, oxygen supplies, and other durable equipment covered under Medicare. Q2. Why is professional billing important in San Diego? Professional billing ensures accuracy, faster reimbursements, and full compliance with Medicare’s regulations essential for San Diego’s growing healthcare network. Q3. How does outsourcing help healthcare providers? Outsourcing reduces administrative work, improves claim accuracy, and enhances cash flow, allowing providers to focus more on patient care. Q4. Are DME and Medicare billing the same? DME billing is a part of Medicare billing that focuses specifically on durable medical equipment claims and documentation. Q5. What makes San Diego a hub for reliable billing services? San Diego combines medical innovation with experienced billing professionals who use advanced systems to simplify Medicare equipment billing.

Why Education Matters for Efficient DME Billing Services in San Diego

In the rapidly changing healthcare landscape, accuracy, compliance, and efficiency have become the pillars of success for every medical organization. This is especially true in the field of Durable Medical Equipment (DME) billing, where even small errors in coding or documentation can lead to delayed reimbursements or denied claims. For this reason, education and continuous training play a crucial role in ensuring that DME billing professionals in San Diego, CA, stay sharp, informed, and effective. Healthcare providers depend on DME Billing Services in San Diego, CA to manage complex billing processes smoothly. Behind every successful claim submission lies a knowledgeable team that understands regulations, payer requirements, and evolving industry standards. Education isn’t just beneficial, it’s essential for keeping these systems running efficiently and compliantly. The Growing Importance of DME Billing in San Diego San Diego’s healthcare industry continues to expand, with medical facilities and DME suppliers serving thousands of patients every day. As demand for medical equipment increases, so does the need for accurate and transparent billing. Medical billing services in San Diego, CA, including those specializing in DME, handle an intricate system of claim submissions, insurance verifications, and compliance checks. Each billing team must stay updated with Medicare guidelines, modifier usage, and HCPCS code updates.That’s why organizations that invest in training and education consistently outperform competitors in speed, accuracy, and compliance. When teams receive consistent education, DME billing companies in San Diego, CA can reduce claim denials, increase reimbursements, and maintain smooth relationships with both healthcare providers and insurance payers. How Education Builds Efficiency in DME Billing Billing efficiency doesn’t just depend on software it depends on people who know how to use it. Education enhances the ability of billing specialists to handle complex tasks with precision. Trained professionals can: Continuous education helps billing staff understand the “why” behind each process. This awareness makes them proactive problem-solvers, reducing administrative delays and improving the overall flow of healthcare billing services in San Diego, CA. Adapting to Frequent Policy and Code Changes DME billing regulations are constantly evolving. Medicare policies, compliance laws, and local coverage determinations (LCDs) often change several times a year. Without consistent training, billing teams can fall behind and unintentionally violate regulations. Education helps professionals in Durable Medical Equipment Billing Services in San Diego, CA stay ahead of updates related to modifiers, documentation standards, and payer-specific rules. A well-informed team can interpret changes quickly and adjust billing procedures accordingly, ensuring claims are always accurate and compliant. This reduces rework, increases first-pass claim rates, and saves both time and money. The Link Between Education and Compliance Compliance is the foundation of any successful billing operation. Healthcare billing companies in San Diego, CA must follow HIPAA rules, Medicare policies, and payer-specific documentation standards. A single mistake or overlooked requirement can lead to audits, penalties, or delayed reimbursements. Education empowers teams to: By making education a regular part of the work culture, medical billing companies in San Diego, CA ensure their staff can perform confidently while meeting every compliance expectation. Training Improves Technology Utilization Modern billing is technology-driven. From claim automation to EHR integration, software plays a massive role in improving billing accuracy. But without proper training, technology can be underutilized or worse, misused. Training programs for DME billing services in San Diego, CA help staff master billing platforms, claim tracking systems, and denial management tools. Trained teams can use reporting dashboards effectively, catch potential issues early, and improve communication between providers and payers. Education ensures that every technology investment truly pays off in terms of efficiency and accuracy. Reducing Errors and Increasing Reimbursements The biggest challenge in DME billing is avoiding denials and delays. Common issues such as missing documents, incorrect codes, or incomplete claims can cost providers both time and revenue. When teams are educated and trained properly, they can identify potential problems before submission. Professionals offering medical insurance billing services in San Diego, CA ensure that every claim meets payer standards right from documentation to coding. This attention to detail reduces denials, increases reimbursements, and enhances provider satisfaction. In short, education directly impacts financial performance and sustainability. Empowering Teams and Building Confidence Education not only sharpens technical skills but also builds confidence. A well-trained billing specialist feels more capable of handling complex cases, communicating with insurance representatives, and solving claim-related issues. This confidence boosts morale and encourages teamwork within healthcare billing companies in San Diego, CA. When employees feel valued and supported through continuous learning, they become more productive and committed to their roles. Strong team confidence also reflects in client relationships providers trust billing partners who demonstrate expertise and professionalism in every claim they process. Long-Term Value of Continuous Learning Education is not a one-time investment. The healthcare industry is dynamic, and continuous learning ensures that billing teams stay current and adaptable. Long-term educational initiatives bring: Organizations that promote training programs and workshops for DME billing specialists in San Diego, CA position themselves as industry leaders focused on quality and compliance. Why San Diego’s DME Billing Companies Must Prioritize Training San Diego’s healthcare providers and DME suppliers operate in a highly regulated and competitive market. To stand out, they need efficient and trustworthy billing support.Companies offering DME medical billing services in San Diego, CA must therefore invest in ongoing staff education. This not only ensures accuracy and compliance but also fosters innovation. Trained teams can adopt new technologies faster, identify better billing strategies, and help providers achieve long-term financial stability. In short, education transforms billing teams into strategic partners who drive both efficiency and growth. Conclusion Education is the cornerstone of effective, compliant, and efficient DME Billing Services in San Diego, CA. Trained professionals bring clarity, accuracy, and consistency to every claim they handle. In an industry where even small errors can have major consequences, knowledge is the most valuable asset a billing team can have. By prioritizing continuous education and skill development, medical billing companies in San Diego, CA can enhance performance, minimize denials, and deliver exceptional service to healthcare providers and patients alike. In

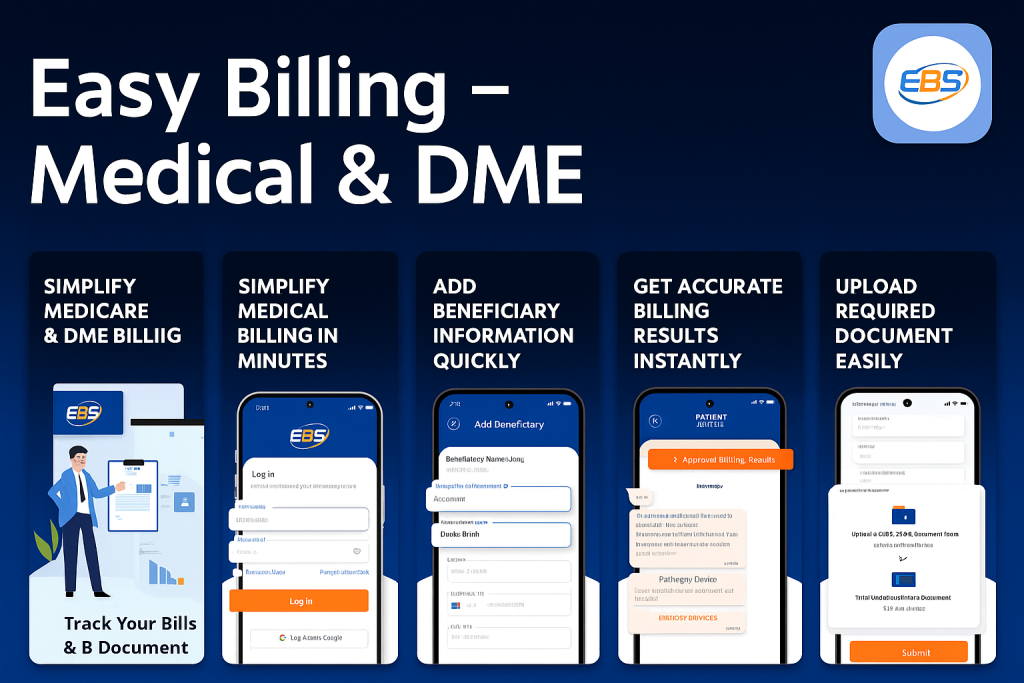

Managing DME Billing Made Easier with the Easy Billing App

In the world of healthcare, billing has always been one of the most time-consuming and detail-oriented tasks. For DME (Durable Medical Equipment) providers, managing claims, payments, and compliance rules can feel overwhelming. Every piece of equipment from wheelchairs and oxygen supplies to hospital beds comes with specific codes, documentation, and billing procedures that must meet Medicare or insurance requirements. That’s where the Easy Billing App steps in a smart, reliable, and user-friendly platform designed to simplify the complexity of DME billing. It doesn’t just make billing faster; it helps healthcare professionals and suppliers manage their operations with confidence and accuracy. Why DME Billing Can Be So Challenging Before understanding how the Easy Billing App helps, it’s important to know what makes DME billing complicated.DME suppliers deal with strict compliance rules, frequent policy changes, and repetitive claim submissions. Each medical item requires the right HCPCS code, the right documentation, and approval from insurers or Medicare. Common challenges include: For small clinics or growing DME businesses, these issues can lead to cash flow problems and administrative stress. The Easy Billing App solves these pain points through automation and smart design. Introducing the Easy Billing App The Easy Billing App is a modern digital tool that brings efficiency and structure to medical billing. Built specifically for DME suppliers, healthcare professionals, and billing specialists, it automates much of the claim process from data entry to final payment tracking. It’s not just another billing app, it’s a complete system designed to save time, reduce errors, and speed up payments. With its simple interface, users can log in, upload patient details, generate claims, and track their status in real-time. It’s built to remove the guesswork from DME billing and make it manageable even for those who aren’t tech experts. How the Easy Billing App Simplifies DME Billing Let’s look at the step-by-step ways the app makes the entire billing process easier: 1. Smart Claim Creation Instead of manually typing every code or checking endless forms, the app lets you create claims with pre-set templates. It automatically fills in the correct DME codes and verifies missing information before submission. 2. Real-Time Validation Errors are one of the biggest reasons claims get rejected. The Easy Billing App validates all data instantly, ensuring accuracy in patient details, billing codes, and provider information before the claim goes out. 3. Faster Submission No more mailing forms or using multiple portals. The app allows direct electronic submission to insurance carriers or Medicare, cutting down on processing time and human error. 4. Live Claim Tracking Once submitted, users can monitor claim progress live whether it’s under review, approved, or pending. This transparency helps billing teams follow up faster and avoid payment delays. 5. Built-in Reporting Tools The app provides powerful reporting and analytics options. Users can track performance, identify bottlenecks, and review which claims were rejected or delayed. This helps businesses improve efficiency over time. The Benefits of Using Easy Billing App for DME Providers Accuracy and Compliance The app keeps your billing accurate and compliant with the latest Medicare and insurance standards. By reducing human error, it protects your revenue and prevents costly claim denials. Time Efficiency Automation saves countless hours of manual data entry and documentation. What used to take days can now be done in minutes. Better Cash Flow When claims are accurate and faster to process, reimbursements arrive on time helping healthcare businesses maintain steady cash flow. Secure and Reliable The app ensures that all patient and billing data is stored securely using HIPAA-compliant encryption, maintaining full confidentiality. Scalability Whether you’re a small clinic or a growing DME company, the app adapts to your needs. It can handle multiple users and growing claim volumes with ease. Why It Matters for San Diego’s Healthcare Providers For DME suppliers and medical providers in San Diego, CA, efficient billing is key to staying competitive and financially stable. The Easy Billing App gives them the advantage of automation and transparency, two things that can drastically improve how they operate. By using a single digital platform, they can manage all claims, patients, and payments in one place. The result is fewer errors, faster processing, and higher satisfaction for both patients and providers. In a city where healthcare demand is growing, using technology like the Easy Billing App can make a real difference in performance and profitability. A Real-World Example Imagine a small DME provider in San Diego handling dozens of claims every week. Before using Easy Billing, they struggled with missing documentation and delayed Medicare payments. After switching to the app, their claim approval rate increased by 40%, and payment turnaround time dropped from three weeks to five days. That’s the kind of impact automation can have real, measurable improvement in how a business runs. Future of DME Billing with Automation As the healthcare industry becomes more digital, billing automation tools are no longer optional; they’re essential.Apps like Easy Billing represent the future of medical billing efficiency combining smart software, accurate data validation, and fast communication with insurers. In the coming years, we can expect features like AI-based coding assistance, predictive claim approval rates, and deeper integration with EHR (Electronic Health Record) systems.The Easy Billing App is already paving the way for this transformation. Conclusion Managing DME billing no longer needs to be stressful or complicated. With the Easy Billing App, healthcare professionals can automate their billing workflow, reduce errors, and focus on what matters most to patients. By simplifying tasks like claim creation, submission, and payment tracking, the app empowers DME providers to take control of their finances and improve efficiency.In a fast-moving industry like healthcare, the Easy Billing App offers something invaluable: peace of mind, accuracy, and speed. FAQs 1. Who can benefit from using the Easy Billing App? The app is ideal for DME suppliers, medical clinics, and billing specialists who handle healthcare insurance or Medicare claims. 2. Is the app available on mobile devices? Yes. The Easy Billing App is available on Android devices through the Google Play Store,

What Is the Easy Billing App and How It Simplifies DME Billing in San Diego

In today’s healthcare industry, billing isn’t just about sending invoices, it’s about managing accuracy, compliance, and speed. For medical providers and DME (Durable Medical Equipment) suppliers in San Diego, the billing process can be time-consuming and prone to errors. That’s where the Easy Billing App steps in. Designed to simplify and streamline the entire medical billing workflow, this app is transforming how healthcare professionals manage claims and payments. Let’s explore what the Easy Billing App does, how it works, and why it has become one of the most trusted tools for DME billing in San Diego. What Is the Easy Billing App? The Easy Billing App is an advanced billing management platform built for healthcare providers, DME companies, and medical billing specialists. It simplifies billing operations by automating repetitive tasks such as claim submission, payment tracking, and compliance checks. Whether you’re handling Medicare claims or insurance reimbursements, the app provides a single dashboard for all your billing needs. What makes it special is its user-friendly interface and real-time tracking system. From small clinics to large medical suppliers, anyone can easily access, manage, and monitor their billing without dealing with complex paperwork or outdated systems. How the Easy Billing App Works The app follows a simple, step-by-step process that even non-technical users can handle effortlessly. Once you log in, you can add patient details, input DME codes, attach supporting documents, and generate claims automatically. The app verifies the data before submission to ensure accuracy and minimize rejections. Here’s a breakdown of how it simplifies the process: This entire workflow helps billing teams avoid delays, manage compliance, and get reimbursed faster all within a few clicks. Why DME Billing Is Complicated Without Automation DME billing requires handling complex documentation, HCPCS codes, and Medicare regulations. Each medical equipment claim must meet strict requirements, and even a minor mistake can lead to rejections or delayed payments. Traditional manual billing often faces these problems: The Easy Billing App solves all these challenges by automating the billing process. It ensures that every claim follows the latest compliance standards while providing transparent updates at each step. Key Features of the Easy Billing App Here are some of the app’s standout features that make it ideal for DME billing in San Diego: 1. Automated Billing System The app reduces manual workload by automating claim creation, verification, and submission. This feature saves hours of repetitive work and minimizes human error. 2. Real-Time Claim Tracking Users can monitor claim progress, view payment updates, and get alerts when actions are needed — ensuring you never miss a payment. 3. Data Security and HIPAA Compliance The Easy Billing App is fully compliant with healthcare data privacy regulations. All patient and provider information is securely encrypted. 4. Multi-User Access The app supports team-based usage, allowing multiple billing specialists to collaborate on claims efficiently. 5. Reports and Analytics Generate monthly, weekly, or custom reports to review performance, identify bottlenecks, and plan improvements. 6. Integration with Medicare and Insurance Systems It seamlessly integrates with Medicare and other major insurance networks, ensuring faster reimbursements and compliance. Benefits for Healthcare Providers and DME Companies For medical equipment providers in San Diego, billing accuracy is essential. Here’s how the Easy Billing App benefits users: By combining technology with practical functionality, the app ensures that billing becomes a smooth and predictable process rather than a stressful one. How It Helps in DME Billing in San Diego San Diego’s medical industry is growing rapidly, and so is the need for accurate billing systems. DME suppliers deal with a variety of medical equipment such as wheelchairs, oxygen machines, and hospital beds all of which require specific billing codes. The Easy Billing App helps local providers by: For San Diego’s healthcare community, this means more productivity, fewer billing delays, and higher revenue retention. Future of DME Billing with Easy Billing App As the healthcare sector continues to evolve, automation tools like Easy Billing are becoming the backbone of billing departments. The app’s continuous updates, integration with new payment systems, and AI-based verification features will make billing even faster and more reliable in the future. In short, Easy Billing App is not just a tool, it’s a digital assistant that simplifies every aspect of medical billing. Conclusion The Easy Billing App is transforming the way DME suppliers and healthcare professionals manage billing in San Diego. It streamlines processes, minimizes errors, and accelerates payments, allowing providers to focus more on patient care. Whether you’re a small DME company or a large medical organization, adopting this app can help you gain better control over your billing workflow and stay compliant with industry regulations. If you’re looking for a smarter, faster, and more reliable way to handle DME billing in San Diego, the Easy Billing App is your perfect partner. FAQs 1. Who can use the Easy Billing App? The app is ideal for DME suppliers, healthcare professionals, and billing specialists who manage insurance and Medicare claims. 2. Is the Easy Billing App available for mobile devices? Yes, it’s available on the Google Play Store, allowing users to manage claims on the go. 3. Does it support Medicare billing? Absolutely. It supports Medicare, Medicaid, and private insurance billing, ensuring compliance with all necessary standards. 4. How does the Easy Billing App reduce errors? It uses automated validation tools that detect missing or incorrect data before claims are submitted. 5. Can multiple users access the same account? Yes, billing teams can collaborate efficiently using the app’s multi-user access feature.

How to Streamline Insurance Claims with Billing Services for Mental Health Providers

Efficiently processing insurance claims is essential for any mental health practice. In today’s competitive healthcare environment, many providers are discovering that partnering with billing services for mental health providers can transform administrative workflows, reduce claim denials, and ensure timely reimbursements. This article is intended to make the case for professional billing services as a means of improving the capture of claims, outline the modern revenue source benefits outline, and provide tips on how to choose the right partner for the practice. Importance of Billing Services For Mental Health Providers A new set of obstacles emerges for mental health practices when billing needs to be managed. Claims filed via insurance can be overwhelming because they are often coupled with reimbursement delays, as well as litigation and coding issues. Such an integrated system greatly reduces the time taken for claims to be processed, minimizes errors when processing claims, and enhances the overall financial well-being of any organization. The truth is that providers, through collaborative arrangements with certain specialists, can emphasize their focus on quality caregiving to patients instead of paperwork. Certainly, it is with those robust-looking billing services that professionals are turning to today for mental health providers, with the aim of improving operational efficiency as well as raising revenue. Such a strategic move is vital for the maintenance of competitiveness. The Role of Specialized Billing Solutions State-of-the-art medical billing features modern and dynamic medical billing solutions, ready to answer all the specific needs tied to mental health service provision: with advanced software and skilled teams trained to handle complex insurance rules and compliance requirements, clinics can benefit from customized billing solutions designed specifically for therapists and mental health specialists. Billing insurance for therapists helps ensure claims are charged accurately and on time. Likewise, psychotherapy billing services do this by ensuring that all necessary documentation is in the proper format and complies with the current standards. While therapy practice billing solutions offer customized services that address the specific financial challenges of mental health care. With the right system, medical billing for mental health practices can be transformed from a daunting task into a spa-like, easy, and predictable revenue cycle. Key Advantages of Professional Billing Partnerships Increased Accuracy and Compliance Errors in claim submission can lead to costly denials and delays. By relying on experts familiar with billing services for mental health providers, practices can drastically reduce the risk of mistakes. The Behavioral Health billing companies that specialize in mental health will guarantee that all these submissions meet all the stringent compliance requirements. Then, of course, practices would also benefit from HIPAA-compliant mental health billing systems, which ensure the safety of sensitive patient data while being fully compliant with regulations. Enhanced Revenue Cycle Management Robust revenue cycle management is crucial for maintaining budgeting operations that are financially stable for mental health services. The outsourced billing with therapists empowers clinics to gain both through well-learned teams focusing on reimbursement optimization. Besides that, billing software for mental health providers is one of the best tools to ensure proper claims recording, tracking, and managing of every claim to enable revenue to flow continually into the business. Streamlining the Claims Process When practices operate with billing services for mental health providers, claim turnaround times improve and claim denial rates reduce. A systematic approach to every claim is put into place by these professional services to guarantee that any activities regarding that claim are handled precisely, from patient intake to their eventual reimbursement. Such a systematic procedure minimizes the delay and enhances payment speed, which is critical for sustaining the practice’s cash flow. Incorporating Technology and Software In the present-day world, there is a huge range of software and technology that improve billing operational efficiency. Several practices adopt billing software for mental health providers to automate some common routines. Those include claim generation and claim status tracking. Such software can easily be fully integrated with patient management systems for easy reconciliation of patient records with insurance claims. In addition, very strong security features are incorporated into modern-day billing platforms, which automatically ensures HIPAA-compliant mental health billing. Such systems obviously offer real-time status updates on claims and various reporting features, allowing practices to keep a close eye on their financial health. Best Practices for Reducing Denials One of the biggest hurdles faced by mental health providers is reducing any instances of claim denials. There are many reasons for denials, with the most common being information missing or incorrect, coding mistakes, or failure to follow the rules laid down by the insurance company. Following the best practices of having two sets of eyes to review entries to make sure they’re accurate, remaining current on all medicare billing requirements, and performing regular audits on claims will solve many of those issues. Additionally, practices can outsource dme billing services to specialized firms that utilize expertise and technology. These measures, combined with expert insights from billing services for mental health providers, can significantly reduce errors and boost reimbursement rates. Choosing the Right Billing Partner It is very important to distinguish between an insurance claim and a billing partner to maximize efficiency. Practices should consider various variables when opting for a billing partner. The focus should be on tactics like mental health billing expertise, technological capabilities, and compliance records. Key Considerations Real-World Impact on Mental Health Practices Most of the mental health practices have improved drastically in their financial well-being after they shifted to dedicated billing services. A recent case study reported a practice that reduced claims denials by more than 40% as an aftereffect of the installation of sophisticated mental health billing. This improvement was credited to the systematic and error-free functioning of the billing partner. Furthermore, those practices that have chronic difficulties in managing insurance papers and making the clients happy can now postulate improvements on the same issue. Such improvements allow most of the therapists more time to spend on patient care rather than on administrative tasks. Providers can redirect resources to further enhance the quality of care by focusing

NPI Type 1 vs Type 2: Which One Do You Need and Why It Matter

If you’re stepping into the world of healthcare billing, credentialing, or setting up your practice or business, you’ve probably heard of NPI numbers. But here’s where things get tricky. Because there are actually two types, and while both seem similar on paper, they serve very different purposes. So let’s walk through this in a way that makes sense, without the jargon or overly technical detours. We’re going to clear the fog surrounding NPI Type 1 vs Type 2, figure out which one you need, and why making the right choice can make or break your medical billing and reimbursement process. What Even Is an NPI Number? NPI stands for National Provider Identifier, a unique 10-digit number assigned by the Centers for Medicare & Medicaid Services (CMS). This number is used to identify healthcare providers across the United States in all kinds of administrative transactions, whether it’s billing, credentialing, or working with insurance payers. It acts as a digital fingerprint for providers, ensuring that your identity is recognized consistently, no matter where or how you’re practicing. But here’s where things get a little more detailed: there isn’t just one type of NPI. There are actually two, and that’s where the confusion often begins. Understanding the difference between NPI Type 1 vs Type 2 is crucial because choosing the wrong one can disrupt everything from claim processing to reimbursement timelines. Whether you’re an individual healthcare provider or running a full-fledged clinic, knowing how NPI Type 1 vs Type 2 applies to your specific situation is key to staying compliant and efficient. Sounds straightforward, right? Well, not quite. Because there are two different types: And that’s where the confusion begins. NPI Type 1 vs Type 2: Let’s Break It Down Here’s a simple comparison: Criteria NPI Type 1 NPI Type 2 Who Gets It Individual providers Healthcare organizations or businesses Example Dr. Smith, an individual practitioner Smith Family Clinic, LLC Required For Credentialing, individual claims Billing for group or facility services Linked To SSN or EIN? SSN (Social Security Number) EIN (Employer Identification Number) Can One Person Have Both? Yes Yes You can absolutely have both if you’re a solo practitioner running a business. You’ll use your Type 1 NPI when billing as an individual and your Type 2 NPI when billing as your company or organization. Why Choosing the Right NPI Type Actually Matters If you’re sending out claims to insurance or Medicare and using the wrong NPI type, you’re inviting headaches. Rejected claims. Delayed reimbursements. Confused payers. Imagine being a DME supplier in California and submitting claims under your individual NPI (Type 1) when you’re actually operating under an LLC. You’re not only risking non-payment but potentially setting yourself up for compliance issues. Here’s why the NPI Type 1 vs Type 2 decision is critical: If you’re a provider thinking of starting your clinic, you’ll need to plan this out carefully from the start. NPI Types and Credentialing Essentials for Doctors Credentialing is where a lot of the confusion hits. If you’re a solo provider, credentialing under your Type 1 NPI makes sense. But what if you’re operating under a business name or a group? That’s where the Type 2 NPI kicks in. When insurance payers credential your group or clinic, they’re credentialing your Type 2 NPI. But when they credential you personally as the treating provider, that’s your Type 1. And yes, you can, and often should, have both. Real-Life Example: A DME Billing Scenario Let’s say you’re a DME provider working out of California. You’ve set up shop legally, filed for an LLC, and are ready to go. You need to: This structure ensures your DME billing services in CA run smoothly, and claims are routed properly. The Contracts and Billing Connection The type of NPI you use directly influences your contracts. If you have contracts for medical billing services, they may need to list your Type 2 NPI, especially if the agreement is with your business entity. For solo providers without an established company, it’s your Type 1 that will appear on contracts and forms. And when it comes to the cost of medical billing services, it often varies depending on whether you’re billing under an individual or organizational model. However, when billing under a Type 2 NPI, you’re representing an organization, such as a clinic, group practice, or DME supplier, which usually involves a higher claim volume, multiple providers, more complex insurance contracts, and added administrative layers. All of this can impact the cost structure. Billing companies often charge a higher percentage for Type 2 setups due to the increased coordination, compliance requirements, and processing complexity involved. Understanding this distinction between NPI Type 1 vs Type 2 can help you better evaluate and negotiate your billing service agreements. For instance, medical billing company percentage rates can vary significantly depending on whether you’re operating under a Type 1 or Type 2 NPI setup. When billing under a Type 1 NPI, you’re usually working as a solo provider, which often means lower patient volume, fewer claims, and a more straightforward billing structure. In such cases, the billing percentage may be lower because the workload is more predictable and easier to manage. So, Which One Do You Really Need? Let’s simplify: Remember, payers care about this. Your credentialing team cares. Your billing company cares. When you’re setting up credentialing, negotiating contracts, or choosing a DME billing company in CA, this question of NPI Type 1 vs Type 2 will be front and center. In Conclusion The divide between NPI Type 1 vs Type 2 isn’t just technical red tape. It’s the foundation for everything that follows in your healthcare career, from how you bill, to how you’re paid, to how your patients receive care. Getting this wrong could slow down your payments or put you in legal hot water. Getting it right means cleaner claims, fewer denials, and faster reimbursements. Clarity matters. And whether you’re new to this or simply reassessing your setup, one truth remains: Understanding your NPI

How the Inflation Reduction Act Is Changing Medicare Drug Coverage (Part D) in 2025

Prescription drugs are one of the biggest expenses for people on Medicare, and many seniors have long struggled with rising prices. The Inflation Reduction Act (IRA), signed into law in 2022, is designed to change that. Its new rules are rolling out in stages, and 2025 is the year when some of the most important protections finally take effect. If you’re wondering how this law will affect your out-of-pocket drug costs, which medications are impacted, and what steps you should take, this article breaks it all down in plain language. What’s Changing in 2025? The Inflation Reduction Act introduced several reforms to Medicare Part D, the prescription drug program. While some changes (like free vaccines) already took effect in 2023, the biggest updates arrive in 2025. Here are the highlights: How Much Will Beneficiaries Actually Save? Savings will vary depending on your prescriptions, but experts estimate that millions of Americans will see lower costs in 2025. For example: Which Drugs Are Affected? Not all drugs are negotiated immediately. The first wave includes some of the most widely used medications for diabetes, cancer, and heart conditions. More will be added over time as Medicare expands its negotiation authority. Even if your specific medication isn’t on the 2025 negotiation list, the overall cost environment is shifting downward. That means drugmakers face pressure to keep prices in check. What Should You Do as a Medicare Beneficiary? With these changes, 2025 is an important year to review your plan and coverage. Here are a few steps to consider: Things to Watch Out For While the Inflation Reduction Act brings major relief, there are still a few pitfalls to keep in mind: Final Thoughts The Inflation Reduction Act is reshaping Medicare Part D in 2025, giving beneficiaries long-awaited relief from runaway drug costs. With the $2,000 annual cap, free vaccines, and the beginning of price negotiations, seniors can finally breathe a little easier when filling prescriptions. Still, the details matter. Taking time during open enrollment to review your plan ensures you get the full benefits of these new rules. With smart planning, you can make the most of these changes and keep more money in your pocket while staying on the medications you need.

Ways to Lower Your Out-of-Pocket Costs in Medicare: Tips & Assistance Programs

Healthcare is one of the biggest expenses for retirees, and even with Medicare, many people are surprised by how much they still pay out of pocket. Premiums, deductibles, copayments, and coinsurance can add up quickly especially if you need regular prescriptions or ongoing treatment. The good news? There are practical strategies and assistance programs that can help you cut costs without sacrificing care. If you’re looking for ways to stretch your healthcare dollars in 2025, this guide is for you. Understand What “Out-of-Pocket” Really Means When we talk about out-of-pocket costs, we’re referring to all the expenses you pay directly beyond your monthly premiums. These include: Knowing exactly where your money is going is the first step toward reducing it. Assistance Programs That Can Help Several government programs are designed to help people with limited income and resources manage their Medicare costs: Applying may feel overwhelming, but local State Health Insurance Assistance Programs (SHIPs) can guide you through the process for free. Reduce Prescription Drug Costs Drug prices are often one of the biggest financial burdens. Here are a few smart ways to cut costs: Medigap vs. Medicare Advantage: Choosing Wisely How you structure your coverage can make a big difference in your long-term costs: The right choice depends on your health needs and budget. Reviewing your situation each year helps ensure you’re not overpaying. Everyday Tips to Keep Costs Down Beyond assistance programs and insurance choices, a few simple habits can reduce your out-of-pocket spending: Final Thoughts Healthcare costs may feel overwhelming, but you have more control than you think. From enrolling in assistance programs like Extra Help and Medicare Savings Programs, to making smart choices about prescriptions and plan selection, there are proven ways to lower your out-of-pocket spending. In 2025, with new policy changes bringing even more relief, now is the perfect time to review your coverage and make adjustments. A little effort can lead to big savings and more peace of mind knowing you’re protected.

Medicare Open Enrollment 2025: Deadlines, Common Mistakes & How to Avoid Penalties

Every year, Medicare offers a crucial window when you can review, change, or update your healthcare coverage. This period is known as Medicare Open Enrollment, and in 2025, it runs from October 15 to December 7. While it may not sound exciting, the decisions you make during these weeks can significantly affect your healthcare and finances in the year ahead. Miss a deadline, choose the wrong plan, or skip a review, and you could end up paying higher costs or facing penalties. This guide will help you understand the key dates, the most common mistakes people make, and how to avoid costly missteps. What Happens During Medicare Open Enrollment? Medicare Open Enrollment (sometimes called the Annual Election Period) is the time when you can: The changes you make take effect on January 1, 2025. Key Dates to Remember 👉 Miss the December 7 deadline? You may have to wait until next year unless you qualify for a Special Enrollment Period (SEP). Special Enrollment Periods (SEPs) Explained Not everyone is locked into the October–December window. Certain life events allow you to make changes outside of Open Enrollment. Examples include: If you fall into one of these categories, you’ll get a SEP, but you’ll need to act quickly deadlines vary depending on your situation. Common Mistakes During Open Enrollment Despite all the reminders, many people still make costly errors. Here are the big ones to watch out for: Penalties to Avoid Medicare penalties are no joke they can last a lifetime. Here’s what you need to know: The takeaway? Even if you’re healthy and rarely need prescriptions, it’s best to enroll on time. A Handy Checklist for Open Enrollment 2025 ✅ Review your current plan’s 2025 changes (you’ll get a notice in the mail). ✅ Make a list of your medications and doctors. ✅ Compare available plans in your area using the Medicare Plan Finder. ✅ Double-check network coverage for your preferred doctors and hospitals. ✅ Enroll or make changes before December 7, 2024. Final Thoughts Medicare Open Enrollment 2025 is your chance to take control of your healthcare coverage. By knowing the deadlines, avoiding common mistakes, and staying on top of penalties, you can ensure you’re getting the coverage that best fits your needs and your budget. Healthcare is one of the biggest expenses in retirement. Spending a little time now to make smart choices will give you peace of mind all year long.

Medicare Advantage vs. Original Medicare: Which Is Best for You in 2025?

Turning 65 or planning for retirement means making some big healthcare decisions and one of the most confusing is choosing between Original Medicare and Medicare Advantage. At first glance, both seem to offer similar coverage. But dig a little deeper, and you’ll see big differences in cost, flexibility, and benefits. As we move into 2025, new rules and updates make this choice even more important. If you’ve been wondering which option is right for you, this guide will walk you through the pros, cons, and key changes to expect this year. Original Medicare: The Classic Choice Original Medicare, run directly by the federal government, is the traditional program most people think of when they hear “Medicare.” It’s made up of: One of the biggest advantages of Original Medicare is freedom. You can see nearly any doctor or hospital in the country that accepts Medicare, with no need to stay in a specific network. For people who travel frequently or split their time between states, that flexibility is a huge plus. But there are downsides too. Original Medicare does not cover prescription drugs, dental, vision, or hearing. That means you’ll likely need to buy a separate Part D plan for prescriptions and possibly a Medigap (supplemental insurance) to help with out-of-pocket costs like deductibles and coinsurance. Medicare Advantage: The All-in-One Alternative Medicare Advantage (also called Part C) works differently. These plans are offered by private insurance companies approved by Medicare. Instead of getting Parts A and B directly from the government, you get your coverage through the insurance company. The big selling point? Bundled benefits. Most Advantage plans include drug coverage, and many go further by adding extras like dental, vision, hearing, and even wellness perks such as gym memberships. In 2025, we’re seeing Advantage plans expand even more with broader telehealth services and richer dental and vision coverage. For many seniors, that makes Advantage a very attractive option. The trade-off is network restrictions. Most Advantage plans work like HMOs or PPOs, meaning you need to use their doctors and hospitals. Go outside the network, and you may pay much more or have no coverage at all. What About Costs in 2025? When it comes to money, the difference between the two options really matters: Which Should You Choose? There’s no one-size-fits-all answer. Your decision should come down to your health needs, budget, and lifestyle: Final Thoughts Deciding between Medicare Advantage and Original Medicare in 2025 is more than just a paperwork choice it can shape how easily you access care and how much you’ll spend. The good news? Both options are designed to protect your health; it’s just a matter of finding which one matches your priorities. Before enrolling, take time to compare plans in your area, review your current prescriptions, and think about your future care needs. A little research now can save you thousands later and give you peace of mind knowing your healthcare is covered.