Healthcare providers and beneficiaries may find it hard to navigate the Medicare claims process due to common claim rejection problems. Learning why these claims are denied is crucial to ensure timely reimbursements without unnecessary delays. This blog discloses the common causes of Medicare claim rejections and offers steps to avoid these problems. Understanding the most common medical claims rejection reasons will help DME billing services learn how to submit medicare claims and make their submission process more efficient.

Understanding Medicare Claims Rejections

A Medicare claim gets rejected if it fails to meet Medicare’s processing requirements. Medicare rejects claims due to many different reasons, along with paperwork mistakes or patient ineligibility. Understanding the reasons behind these rejections helps providers and beneficiaries ensure better preparations to prevent these problems.

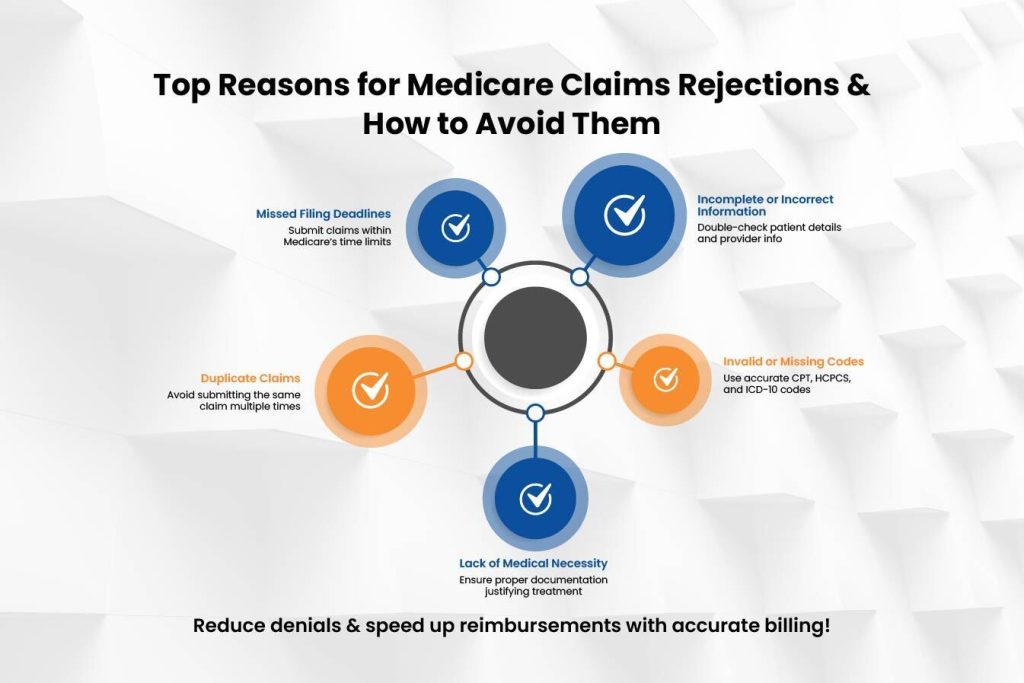

- Incomplete or Incorrect Information

One of the biggest common reasons for Medicare claims rejection is missing or incorrect information. Typing errors as simple as patient names, birth dates, provider details, or procedure codes can result in automated denials. Small mistakes also lead to claim denials. It is important to thoroughly review all the entered information to ensure accuracy.

- Duplicate Claims Submission

Filing multiple claims for the same treatment will lead to unwanted rejections. When medical providers and billing staff cannot communicate properly or administrative errors occur, duplicate submissions can be made. Providers need a tracking system to monitor submitted claims and verify their status before resending them.

- Lack of Medical Necessity

Medicare requires services and procedures to be medically necessary. Medicare approves claims only when a service aligns with its medical necessity criteria. Healthcare providers need to show why the service is needed using doctor notes along with test results and medical history. Documentation proves that treatment is needed and improves your chances for claim approval.

- Failure to Meet Timely Filing Deadlines

Timely submission is important when dealing with Medicare claims. Medicare requires doctors to submit claims for medical services within 12 months after the treatment is provided. Late submissions will lead to automatic claim rejection. A well-designed claims submission process helps healthcare providers meet all deadlines and decreases the number of claims rejected by Medicare.

- Incorrect Coding or Billing Errors

Medical coding is also a crucial function in claims processing. Errors such as incorrect CPT, HCPCS, or ICD-10 codes can lead to claim rejections. Moreover, incorrect or absent modifiers can affect the claim approval. Staying updated about the guidelines of coding and investing in staff training in billing can minimize the above mistakes. Using coding software and audits also decreases the occurrence of coding errors.

- Coordination of Benefits Issues

Patients with multiple insurance plans require proper coordination of benefits to determine whether Medicare is the primary or secondary payer. Failure to do this properly can lead to a claim rejection. Ensuring accurate insurance details and verifying payer sequences before submitting a claim can resolve this issue. Verification of the patient’s secondary insurance provider and coverage information can further reduce rejections.

- Missing or Insufficient Documentation

Some Medicare claims need to be supported by documentation, e.g., physician orders, lab reports, or authorization forms. Incomplete or missing documents may lead to rejection. Providers should verify all paperwork needed before submission to ensure seamless claim processing. Having a checklist of the required documents will ensure nothing is left behind before filing a claim.

- Services Not Covered by Medicare

Medicare does not cover all medical procedures. If a service is not within Medicare’s coverage policies, the claim will be rejected. Providers are to check coverage prior to rendering services and advise patients if a procedure is not likely to be reimbursed. Patients should also be informed of other coverage possibilities or out-of-pocket expenses prior to receiving non-covered services.

- Provider Enrollment Issues

Providers must be enrolled and certified by Medicare to make claims. Claims will be denied if a provider’s enrollment has expired or is incomplete. Periodic checking of provider enrollment status prevents such situations. Keeping all required credentials, licensure, and Medicare agreements current can avoid surprise claim denials.

- Patient Eligibility Issues

Eligibility confirmation is important in processing Medicare claims. If the patient is not eligible for Medicare during service, the claim will be rejected. Providers must confirm eligibility information, such as plan type and coverage, prior to treatment. Real-time Medicare eligibility checks via online platforms can prevent claim denials based on eligibility.

How to Prevent Medicare Claims Rejections

To minimize the chances of rejections of Medicare claims, follow these best practices:

- Check patient and insurance information prior to submission.

- Employ correct and current medical codes.

- Document medical necessity thoroughly.

- Make claims within Medicare’s time frame specifications.

- Maintain knowledge about Medicare’s coverage policies.

- Submit claims electronically to eliminate human error.

- Stay up-to-date with Medicare policy changes and coding changes.

- Provide billing personnel with regular training on the current claim submission processes.

- Use claim scrubbing software to eliminate errors prior to submission.

What to Do If Your Medicare Claim Is Rejected

If your Medicare claims are rejected, take the following steps:

- Read the Medicare Summary Notice (MSN) or Explanation of Benefits (EOB) to see why it was denied.

- Make corrections for clerical errors and re-submit the claim if required.

- If you believe that you have been incorrectly rejected, then appeal with backup documents.

- Speak to Medicare or your billing vendor for further instructions on how to rectify the matter.

- Keep clear records of claims sent in, appeals made, and the responses from Medicare to refer back to.

- Consider seeking professional help if there are continuous rejections.

Final Verdict

Understanding the most common medical claims rejections can help healthcare providers and beneficiaries avoid unnecessary delays and denials. Properly documented, timely submitted, accurate information reduces the number of denied medicare claims. Working with an expert like Easy Billing Services LLC® reduces administrative work and increases your chances of reimbursement. Understanding Medicare requirements before filing claims helps you minimize delays and issues during the process and ensure a smoother claims experience.

Learn more about why your medicare claim has been denied by contacting the professionals over the phone at 877-306-2906 or email info@easybillingservices.com to find out more.

Frequently Asked Questions

What is a Medicare claim number?

A Medicare claim number is a distinct claim number to process Medicare services and monitor medical services and claims.

How to submit a Medicare claim?

Submit the CMS-1500 form to the appropriate Medicare claims processing center

through electronic or postal submission.

How to submit a claim to medicare?

You can submit a Medicare claim when you have all the needed documents and send it before the deadline.

What are the most common medical claims denied by Medicare?

The most common medical claim rejections occur when medical records lack important patient data, missing paperwork, or incorrect coding.

What should I do if my Medicare claim is denied?

If your Medicare claim is denied, check the notice, fix the errors, and submit an appeal if allowed.