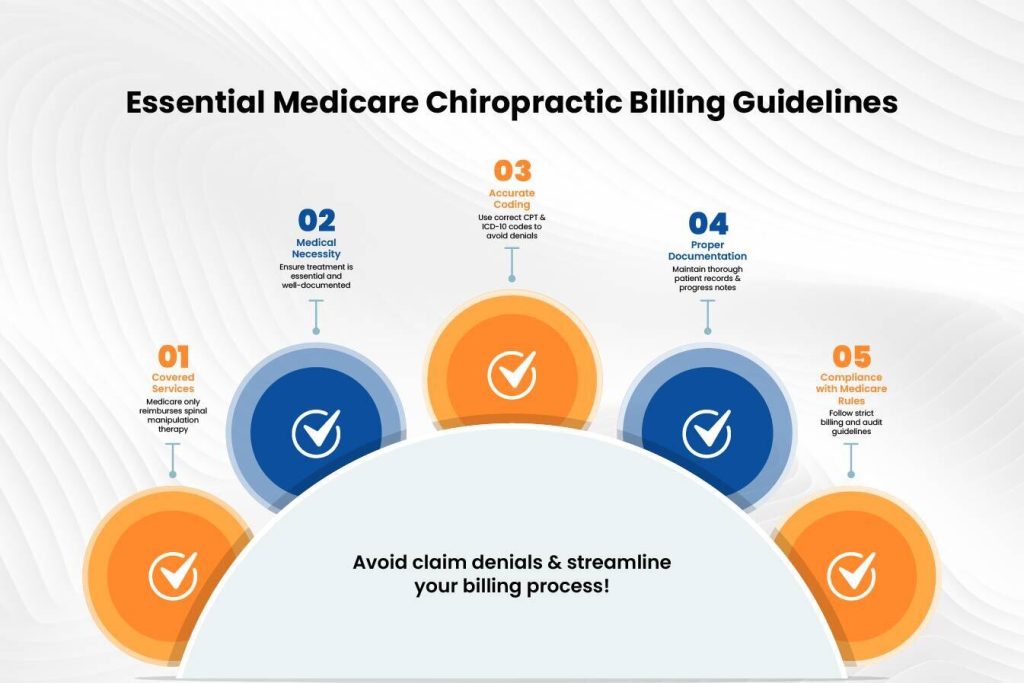

Medicare coverage of chiropractic services has strict regulations that providers must abide by in order to allow proper reimbursement. Medicare chiropractic billing guidelines may be tricky to navigate, but by following these critical rules, claim denials and compliance are avoided. When seeking dependable Chiropractic billing services, familiarity with these guidelines is the beginning of maximizing your revenue cycle.

Verify Patient Eligibility and Medicare Coverage

Verify if the patient qualifies for Medicare services before starting treatment. Medicare chiropractic billing guidelines define that Medicare Part B only covers chiropractic services for spinal manipulation or chiropractic adjustments. Medicare does not cover X-rays, physical therapy, and acupuncture when chiropractic services are delivered. Check service coverage limitations and benefits first to prevent billing errors before rendering services. Patients need to know their Medicare coverage to avoid paying more than expected.

The Medicare eligibility verification process involves checking the patient’s Medicare card and validation of details using the Medicare Administrative Contractor (MAC) portal. Chiropractors also need to know Medicare Advantage Plans, which might use varied criteria for coverage. Providing proper patient information reduces claim denial and speeds reimbursement.

It is also necessary to inform patients about their Medicare coverage so they have a clear idea of which services will be billed to Medicare and which ones will be out-of-pocket payments. Effective communication with patients can avoid billing errors and enhance patient satisfaction.

Use Correct Chiropractic CPT Codes and Modifiers

According to Medicare chiropractic billing guidelines, accurate coding is necessary when billing Medicare. Chiropractors need to use the appropriate CPT codes for spinal manipulation:

- 98940 – Spinal manipulation (1-2 regions)

- 98941 – Spinal manipulation (3-4 regions)

- 98942 – Spinal manipulation (5+ regions)

In addition, append the AT modifier (Active Treatment) to report that the service is medically required. Claims that lack the AT modifier can be denied because Medicare only pays for active treatment and not maintenance care. Understanding Medicare chiropractic billing guidelines will promote correct coding techniques and reduce claim denials.

The use of modifiers must be proper to prevent errors. Additional modifiers like GA (waiver of liability) and GZ (denial anticipated as not reasonable or necessary) could be necessary based on the circumstance. Chiropractors must remain up-to-date with Medicare’s coding updates to avoid unwarranted denials.

Coding mistakes are among the most frequent causes of claims denial. According to Medicare chiropractic billing guidelines, chiropractors need to regularly audit their coding methods for compliance. Staff can also be trained in proper coding procedures in order to reduce errors and enhance reimbursement rates.

Maintain Detailed Documentation

Accurate documentation is critical for Medicare compliance. Chiropractors are required to maintain complete records, such as:

- Initial patient history and physical examination.

- Diagnosis and treatment plan.

- Objective measures of progress.

- Detailed notes on each visit, including subluxation findings and response to treatment.

Inadequate documentation can lead to claim denials or audits, so document each visit thoroughly. Treatment plans must demonstrate specific results and care session lists and explain when to monitor patient progress. Medicare needs thorough records to verify treatment as medically necessary, which necessitates healthcare providers maintaining organized and up-to-date documents.

EHR (Electric Health Record) systems help doctors record medical information correctly and meet all standards while decreasing errors in their work. Using an EHR system that connects to Medicare speeds up payment processing and reduces claim errors.

Accurate documentation not only supports claims but also protects from an audit. Chiropractors must review patient records on a regular basis to confirm that they comply with Medicare chiropractic billing guidelines and documentation standards.

Understand Medicare’s Exclusion of Maintenance Therapy

Medicare does not cover maintenance therapy, and care is given when the patient is no longer demonstrating functional improvement. Document the patient’s functional improvement with each visit to avoid denials. If Medicare deems that the treatment is maintenance care, reimbursement can be denied, and the patient would have to pay out-of-pocket.

Chiropractors should guarantee that their documents support active treatment and justify ongoing care. Functional gain is expected in the range of motion, pain, and activities of daily living. Should maintenance care become necessary, notice should be given to the patients that Medicare won’t pay for the services, and a signed Advance Beneficiary Notice of Noncoverage (ABN) should be secured to alert them.

Failure to distinguish between active and maintenance care may result in compliance risks. Routine re-evaluation and revision of the treatment plan should be performed to establish medical necessity and align with Medicare chiropractic billing guidelines.

Submit Clean Claims and Appeal Denials When Necessary

To minimize claim denials, double-check claims for accuracy prior to submission. Make sure that:

If a claim is denied, check the denial reason and appeal with supporting documentation. A chiropractic medical billing company can help in preparing appeals effectively to optimize reimbursement. Adhering to Medicare chiropractic billing guidelines guarantees that claims are submitted properly and reduces payment delay.

Denial appeals need to be done in a systematic manner, such as filing a redetermination request within the specified time limit. Chiropractors must also monitor their denial rates and review patterns to avoid repeated problems. Outsourcing billing services to a professional company can make the process easier and enhance revenue cycle management.

An active billing strategy can greatly lower claim denials. Periodic checks on Medicare’s billing policies and revising processes in line with them can improve revenue cycle effectiveness.

Final Thoughts

Mastering Medicare chiropractic billing guidelines guarantees ease in claim processing and the highest reimbursements. Through patient eligibility verification, application of proper codes, accurate documentation, avoiding maintenance therapy claims, and submitting clean claims, chiropractors can optimize billing. For expert help, hire a chiropractic medical billing company to process your billing smoothly.

Need professional assistance? Reach out to a group of billing experts like Easy Billing Services LLC® to take care of your claims. Master Medicare chiropractic billing guidelines and boost your practice revenue today!

Get assistance by contacting the experts via phone at 877-306-2906 or send an email to info@easybillingservices.com.

Frequently Asked Questions

What chiropractic services does Medicare cover?

Medicare Part B covers only spinal manipulation for subluxation. Medicare does not pay for X-ray examinations or physical therapy services.

How do I ensure my chiropractic claims are not denied?

Follow Medicare rules by entering CPT codes with AT modifier plus record all patient visits according to Medicare rules.

How much do chiropractic billing services charge?

The cost depends both on the scope of the service and the size of the practice. Get an individualized price from your billing provider.

How do I bill Medicare for chiropractic services?

You should follow all Medicare chiropractic billing guidelines while selecting valid CPT codes, checking if the patient qualifies, and creating medical records to back up your insurance claim.

How to bill for chiropractic services?

Chiropractic service billing requires checking Medicare eligibility along with selecting accurate CPT codes and needed modifiers while maintaining thorough documentation.